Stop Guessing. Start Leading. Get the financial clarity to grow your business.

Whether you're fixing your books or planning for growth, you need more than a bookkeeper. You need a partner.

You're not alone in the chaos.

Which owner are you today?

Heard '$10K Cleanup' and Panicked? There's Another Way.

Your books are a mess. You're mixing personal and business expenses, you dread tax season, and you're terrified of an IRS penalty. You know you need help, but you're worried about the cost of a 'cleanup'.

Growing Fast But Can't Answer: 'Can I Afford This Hire?'

You have data, but no insights. You're 'growing but have no liquidity'. You're stuck on critical questions like 'Can I afford this new hire?' or 'What's our real cash flow for the next 13 weeks?'. You're ready to scale, but you're 'flying blind'.

You Don't Need a Vendor. You Need An Always-On Partnership.

We know some owners don't know how to read a P&L —and that's okay. We schedule regular calls to walk you through your numbers, using storytelling to translate complex data into a clear roadmap. Our goal isn't just to clean your books; it's to help you 'trust your numbers' and make confident decisions.

We Don't Just Send Reports. We Teach You to Read Them.

We Don't Just Clean Your Books. We Build Your Financial Confidence.

We Don't Just Fix Problems. We Prevent Future Chaos.

Five Ways We Bring Clarity to Your Financial Life.

Whether you're drowning in DIY bookkeeping or ready to scale strategically, we have a partnership approach designed for your exact stage.

Fix Years of Messy Books Without the $10K Sticker Shock.

We've heard the horror stories—$10,000+ cleanup quotes that make you want to give up. Our cleanup service is different: transparent pricing, zero judgment, and a side-by-side partnership to untangle everything from misclassified expenses to missing receipts. We'll get you back to zero and set you up so it never happens again.

Best For: Business owners who've fallen behind and need a financial "do-over."

Clean Books You Can Actually Trust.

We take over the chaos—categorizing transactions, reconciling accounts, and building a foundation of IRS-proof books. Then we teach you how to read them. No more Sunday night panic. No more mixing personal and business. Just clean, reliable books and the confidence that comes with them.

Best For: Solopreneurs, consultants, coaches, and small business owners who need to fix the foundation.

Payroll That Actually Gets Done Right (and On Time).

Payroll isn't just about cutting checks—it's about compliance, tax filings, and avoiding penalties. We handle it all: processing, tax deposits, quarterly filings, and year-end forms. You focus on your team; we make sure everyone gets paid correctly and the IRS stays happy.

Best For: Growing teams that need reliable, compliant payroll without the headache.

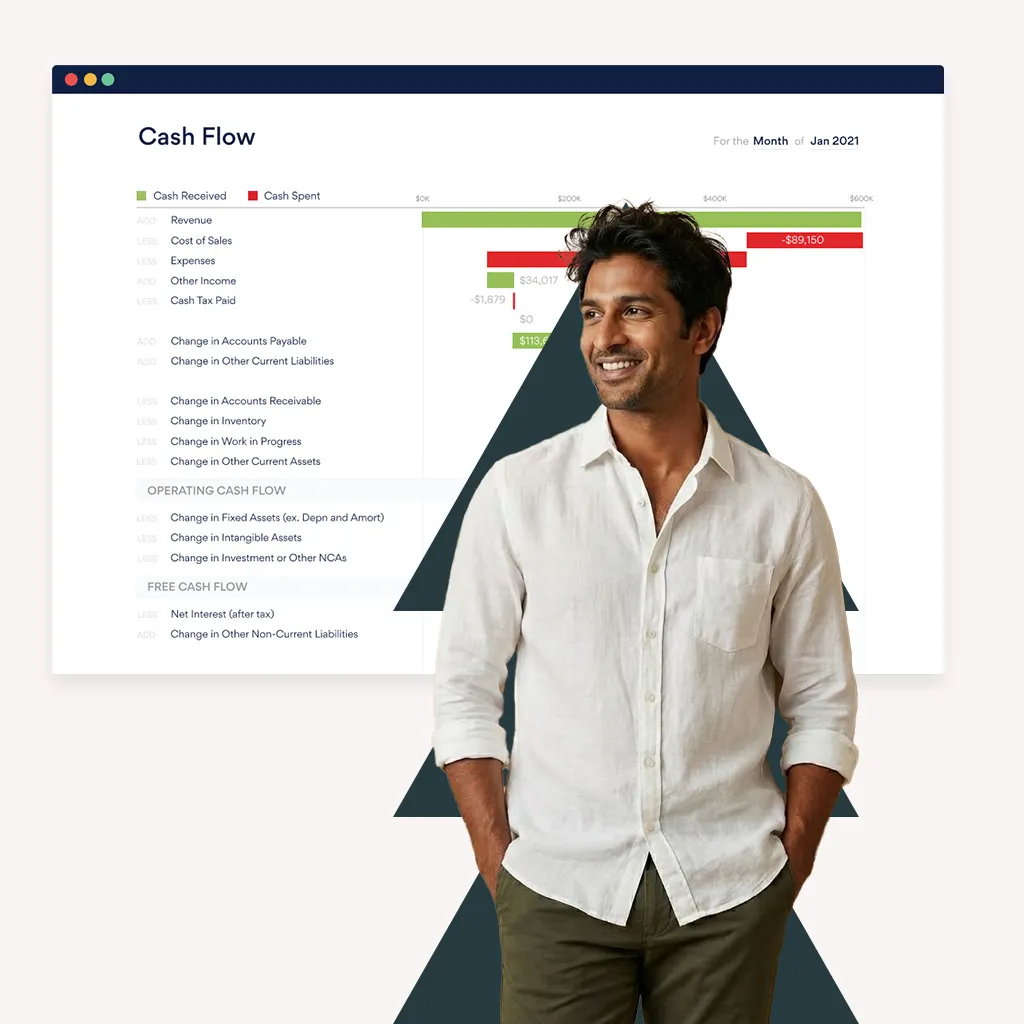

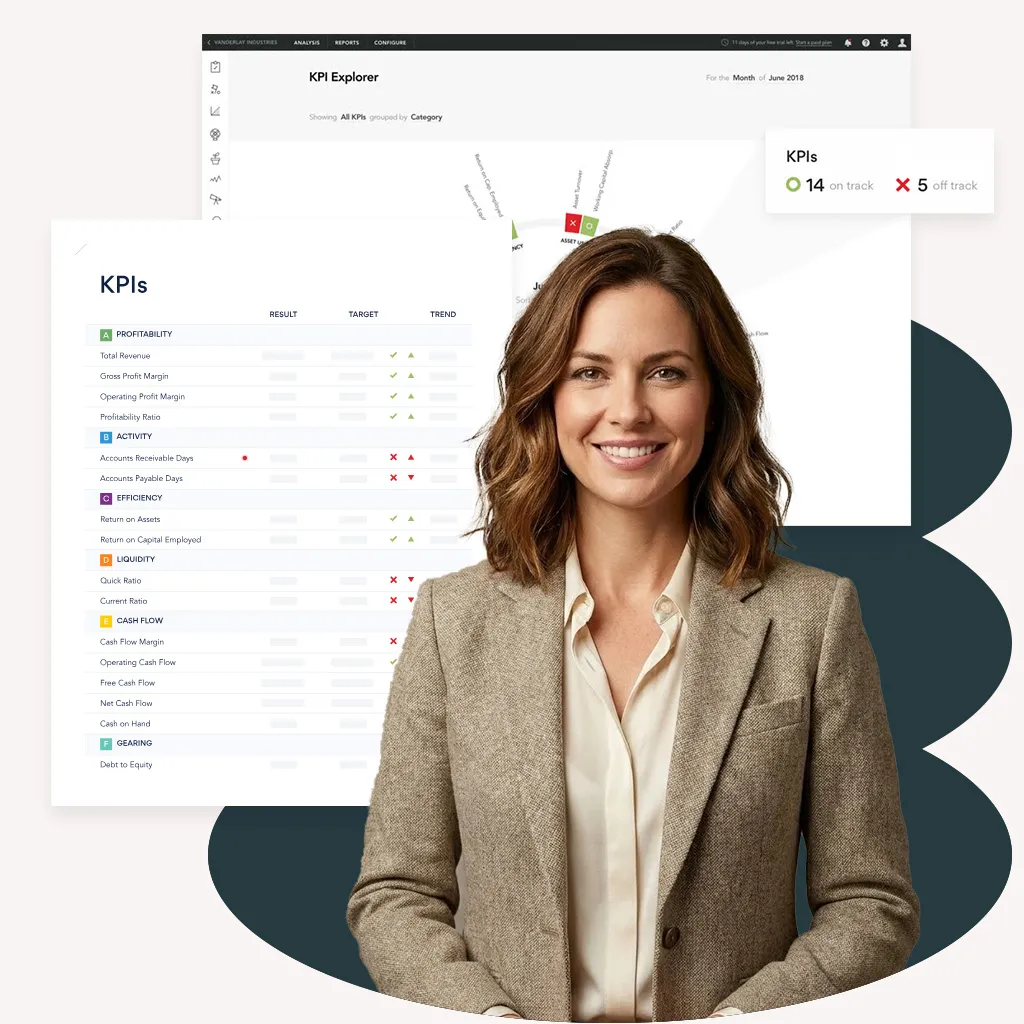

Investor-Ready Reporting & Strategic Insights.

When banks, boards, or investors ask for your numbers, "I think so" isn't enough. We turn your financial data into professional, board-level reporting packages that tell a clear story of stability and growth. Whether you are raising capital or renewing a line of credit, we give your stakeholders the clarity they demand—and you the confidence to lead the conversation.

Best For: Established businesses with over 1 million per year in revenue ready to scale with strategic clarity.

Your Strategic CFO Partner (Without the $250K Salary)

You're making big decisions—funding, hiring, expansion—but you're flying blind.

You've outgrown basic bookkeeping, but you're not ready for a full-time CFO. Our Fractional CFO service gives you executive-level financial leadership on demand: strategic planning, fundraising support, cash flow management, and a partner in the room for every major decision. Think of us as your CFO in the passenger seat—guiding you through growth without the overhead.

Best For: CEOs and founders ready for strategic financial leadership and scalable systems.

Real Businesses. Real Results.

Don't just take our word for it.

The Industry's Most Trusted Financial Tools, Optimized for Your Business.

We use enterprise-level tools that give you institutional-quality insights without the enterprise-level complexity. You get professional results with the clarity to make confident decisions.

You Shouldn't Need a Finance Degree to Run Your Business.

Hi, I'm Juan Carlos. I started ROCA after one too many calls with brilliant business owners who thought they were failing—when really, they just had messy books and no one to explain what the numbers meant.

Most financial services are transactional: send a report, send an invoice, see you next month. But what owners actually need is someone who sits beside them, teaches them to read their P&L, and answers the "stupid questions" without judgment.

That's what ROCA is. I'm not here to just do your books. I'm here to help you finally trust your numbers and make confident decisions. Whether it's a weekly call to review transactions or strategic planning for your next hire, I'm your partner—not your vendor.

.webp)

Questions?

Everything you need to know about working with us

You get a dedicated CFO on a part-time basis, scaled to your needs. No overhead. No long-term contracts. Just experienced financial leadership when and where you need it most.

Having a CPA you trust is a huge advantage. We don’t replace your CPA. We work alongside them. Our role is to handle the day-to-day bookkeeping, reporting, and financial management so your CPA can focus on what they do best—tax strategy, compliance, and filings. We stay in sync with your CPA throughout the year. This helps keep your books clean, your numbers accurate, and your year-end process smooth and stress-free.

Most engagements begin within two weeks. We'll spend the first phase understanding your business, your numbers, and your goals. Then we build a plan and execute.

We work with growing companies across tech, e-commerce, manufacturing, professional services, and beyond. If you're scaling and need financial clarity, we can help.

Yes. We support fundraising by making sure your financial foundation is solid and your story is clear. That includes clean, accurate books, strong monthly reporting, financial models, forecasts, and the key metrics investors look for. We help you understand your numbers, prepare for due diligence, and present a realistic plan for how the investment will be used. While we don’t act as brokers or raise capital directly, we handle the accounting and financial planning work that gives investors confidence and helps you move through the process smoothly.

Still have questions?

Reach out and let's talk

Ready to take control?

You don't have to stay stuck in 'financial chaos'. Book a free 15-minute call.